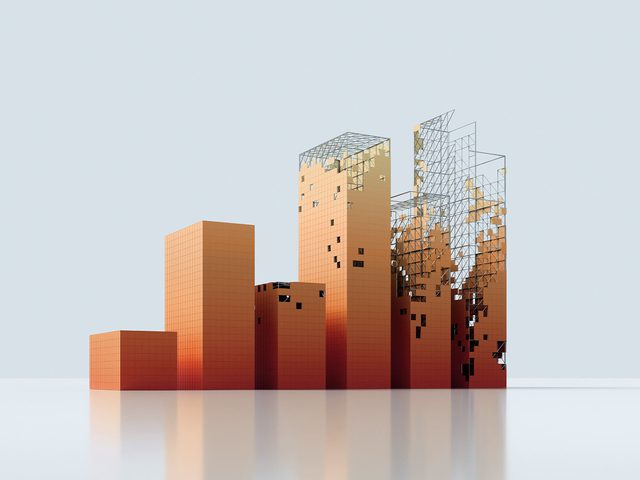

Fast-Track Technical Assessment for Informed Decision Making

Foundational Due Diligence

Our foundational technical due diligence provides a fast, structured read on an acquisition target’s technical realities. In one week, we deliver a concise assessment of the product infrastructure, architecture, security, and development operations.

Through a 90-minute product demo and clarifying meeting, we evaluate the DevOps maturity, R&D team capabilities, and overall technical readiness. You'll receive detailed deliverables including demo recordings, meeting notes, DevOps capability assessment, and a complete technical due diligence writeup with initial reads on the architecture quality and team effectiveness.

The result is clear, actionable insight you can use to validate assumptions and move your deal forward with confidence.